The Budget of the United States Government often begins as the President’s proposal to the U.S. Congress which recommends funding levels for the next fiscal year, beginning October 1

10 Interesting Facts About The Budget of The United States Government:

1. The U.S. Constitution (Article I, section 9, clause 7) states that “No money shall be drawn from the Treasury, but in Consequence of Appropriations made by Law; and a regular Statement and Account of Receipts and Expenditures of all public Money shall be published from time to time.” Congress may also pass ‘Special’ or ‘Emergency’ Appropriations.

2. The Federal Agencies cannot spend money unless funds are authorized and appropriated. Appropriations bills must pass both the House and Senate and then be signed by the president in order to give federal agencies the legal budget authority to spend.

3. A “backdoor authorization” occurs when an appropriation is made and an agency required to spend the money even when no authorizing legislation has been enacted. A “backdoor appropriation” occurs when authorizing legislation requires an agency to spend a specific amount of money on a specific project within a specific period of time.

4. There are some government agencies which provide budget. These include:

a. The Government Accountability Office (GAO)

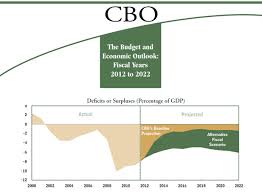

b. The Congressional Budget Office (CBO)

c. The Office of Management and Budget (OMB)

d. The U.S. Treasury Department.

5. Major Dimensions of The United States Federal Budget include:

a. Economy

b. Expenditure

c. Federal Budget

d. Financial Position

e. Military Budget

f. Public Debt

g. Unemployment

6. U.S Federal Tax Receipts Of The Year 2013 is Shown below with the help of a Pie-diagram:

7. U.S Federal Spending for the year 2013 is shown below with the help of a Pie-diagram:

8. The Major Expenditure categories of The U.S Federal Budget is shown below:

9. Relationship of deficit and debt.

Intuitively, the annual budget deficit should represent the amount added to the national debt. However, there are certain types of spending (“supplemental appropriations”) outside the budget process which are not captured in the deficit computation, which also add to the national debt. The following diagram will help you to understand it more clearly:

10. The President’s budget also contains revenue and spending projections for the current fiscal year, the coming fiscal years, as well as several future fiscal years. The Congressional Budget Office (CBO) issues a “Budget and Economic Outlook” each January and an analysis of the President’s budget each March. CBO also issues an updated budget and economic outlook in August.

Source : Wikipedia

54 Comments