This matrix was developed in 1970s by the General Electric Company with the assistance of the consulting firm, McKinsey & Co, USA. This is also called GE multifactor portfolio matrix.

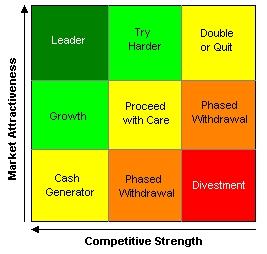

The GE matrix has been developed to overcome the obvious limitations of BCG matrix. This matrix consists of nine cells (3X3) based on two key variables:

i) business strength

ii) industry attractiveness

The horizontal axis represents business strength and the vertical axis represent industry attractiveness

The business strength is measured by considering such factors as:

- relative market share

- profit margins

- ability to compete on price and quality

- knowledge of customer and market

- competitive strengths and weaknesses

- technological capacity

- caliber of management

Industry attractiveness is measured considering such factors as :

- market size and growth rate

- industry profit margin

- competitive intensity

- economies of scale

- technology

- social, environmental, legal and human aspects

The industry product-lines or business units are plotted as circles. The area of each circle is proportionate to industry sales. The pie within the circles represents the market share of the product line or business unit.

The nine cells of the GE matrix represent various degrees of industry attractiveness (high, medium or low) and business strength (strong, average and weak). After plotting each product line or business unit on the nine cell matrix, strategic choices are made depending on their position in the matrix.

67 Comments