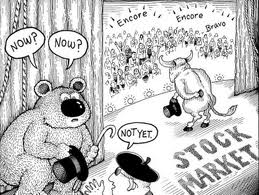

Bull v/s The Bear Scenario

It’s a bull scenario in the economy!! Or it’s a bearish scenario in the economy!!Sounds Gibberish isn’t it ??Let’s makes sense and translate these sentences for a common understanding. A bulls scenario is when everything in the economy is perfect the stocks are rising, employment is high, GDP is increasing. The bullish scenario usually occurs when there is a boom in the economy but it is not always that the bullish scenario will sustain for that is most unlikely to happen. A major mistake that investors usually make is that due to ‘the perfect scenario’ in the market they end up having overvalued stocks instead due to overconfidence in predicting the reigning market scenario.

Bearish market on the contrary is the opposite it is when everything in the economy is not at all perfect the Great recession faced some time ago is a perfect example of a bearish scenario. The side effects of the bearish scenario is unemployment, a situation of handful investors for it is difficult for investors to choose a share that will be profitable because the entire economic scenario is too frustrating for the investors to invest. For the shares might be sold at a lower rate but the profitability for the same will be hard to determine. A key strategy that must be followed during this scenario is that one must be patient for the upcoming bullish scenario which will end up being a win- win situation for the investors for they will buy the stocks at a lower price during the bearish scenario and end up selling it at a higher price during the bullish scenario which would result in a profitable situation .

Khyati Kotian

42 Comments